Filing Your Tax Returns Early Could Cost You $1400 in Stimulus Money

Why wait to file your 2020 tax returns

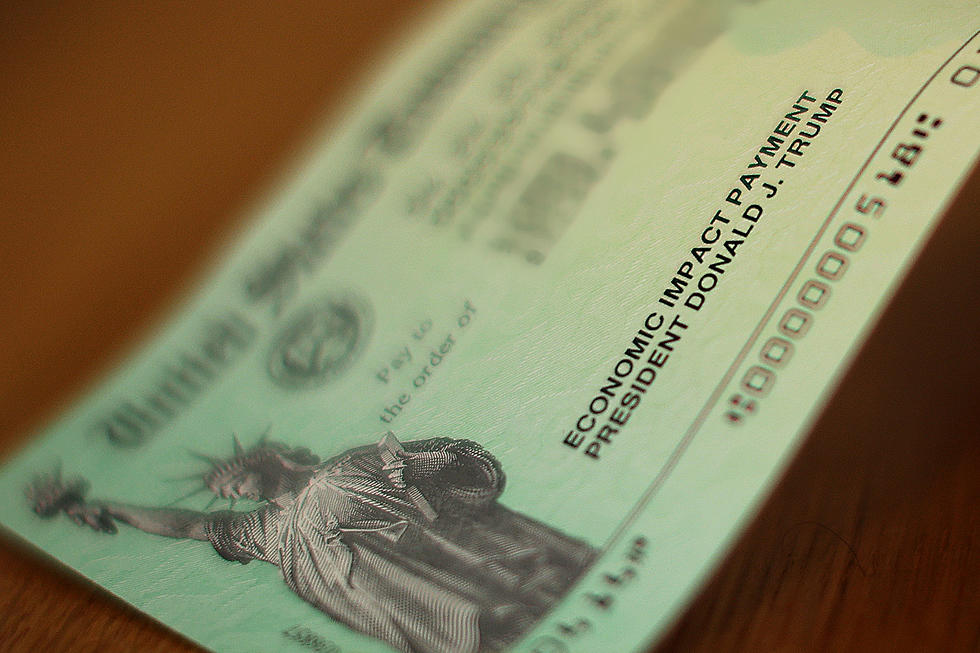

Congress is currently working on another round of stimulus checks for Americans. Millions of American taxpayers could be getting a third stimulus check mid to late March. But filing your tax returns early could make you ineligible for the third stimulus check.

It's tax season and many Americans are filing 2020 taxes now to beat the rush. Filing now could lose some families up to $1,400 in new stimulus money.

As Congress decides on who's eligible for the third round of stimulus checks, most financial analysts predict the requirements will be identical or close to the requirements for the first two. That means individuals who made less than $75,000 and couples who made less than $150,00 in 2019, received two stimulus checks so far.

The reason why waiting to file can help

The federal government used 2019 tax information to decide who qualified and who didn't. They will use your 2019 tax information again for the third stimulus check unless you file early. If you file your taxes before Congress sends out the third round of checks, they will use your 2020 taxes instead.

Remember, your 2020 tax returns will include the first two rounds of stimulus checks which could impact whether or not you qualify for the upcoming stimulus check. Also, let's say your job status changed for the better in 2020, again, you may not qualify for the stimulus money Congress is currently working on. Anything that increased your income in 2020 over 2019 could determine if you'll get the upcoming stimulus relief.

However, if you wait until Congress makes their decision on the third stimulus check before filing your 2020 taxes, the government will use your 2019 information as before. So if you received stimulus money already, you'll likely get the third check as well. But if you file your 2020 taxes before Congress sends out the third round of checks, it could cost you.

Congress has until March 14, 2021, to get the new stimulus package to the President. And historically, things get delayed in Washington, so the arrival date for the third stimulus check could indeed be later than expected.

The reason why waiting to file can hurt

If you didn't qualify for the first two rounds of stimulus money, the flip side of this political pancake is if your financial situation is worse now than in 2019 and you now qualify for stimulus relief, you should get your taxes filed as soon as possible. That way the feds will use your 2020 tax information instead.

So you'll need to watch things carefully as the deadline to file your 2020 taxes is April 15, 2021.

KEEP READING: See the richest person in every state

More From 99.9 KTDY